MemberMouse does not offer VAT / Tax support, which is a very important aspect required by many membership sites owners, including MemberMouse.

If you need to handle taxes and you want to use MemberMouse, you can:

1. Contact your payment processor provider and check with them if they offer tax support

2. Integrate MemberMouse with WooCommerce, and not only enjoy tax support, but also benefit from all other features WooCommerce offers

WooCommerce has worldwide tax support that handles all taxes depending on the country your business is located in.

Integrating MemberMouse & WooCommerce:

Integrating MemberMouse and WooCommerce can be easily done using the very popular plugin MemberMouse WooCommerce Plus.

MemberMouse WooCommerce Plus does not interfere with the regular WooCommerce purchasing process what so ever.

WooCommerce is the one responsible for the payment transactions and tax calculation, if and when they need to be applied, according to the settings you define inside your Woo store.

MemberMouse WooCommerce Plus creates the integration between WooCommerce and MemberMouse , so you can create membership products, and after customers purchase it, they are automatically added to the appropriate membership level and bundles.

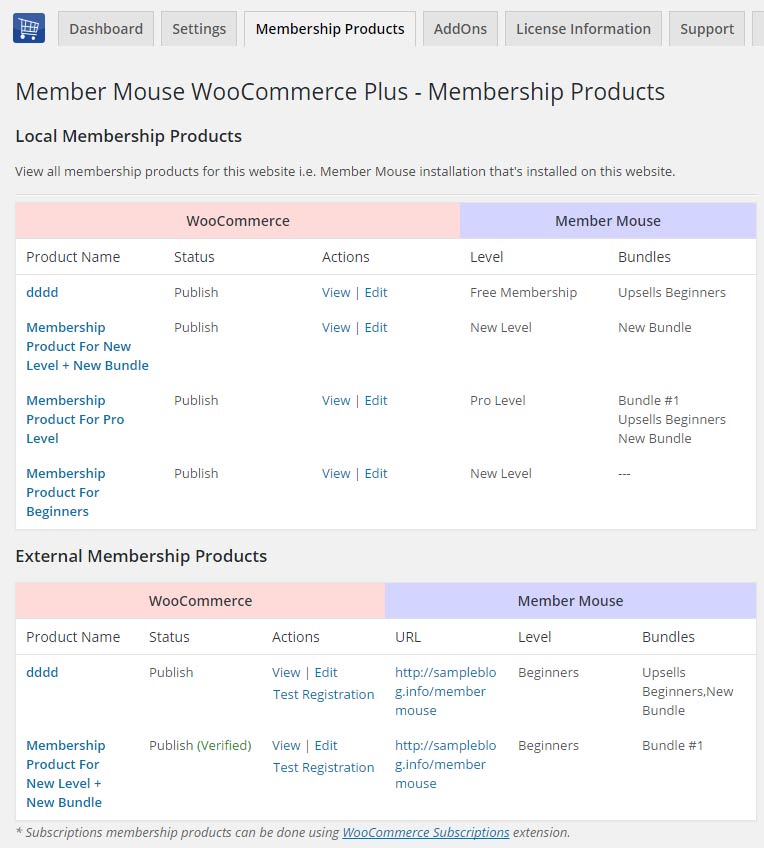

Here is the integration screen settings of MemberMouse WooCommerce Plus:

MemberMouse WooCommerce Plus Exclusive Features:

- Ability to Sell MemberMouse Membership multiple types of products in one cart, for example: physical products, digital goods, membership levels and bundles and more…

- Duplicate Membership Level Purchase Prevention

- Ability to Register Members to External Membership Sites (If your membership site and store are located on different WordPress installations / sites)

- Advanced membership products summary table, including: Product name, status, relevant membership level and bundles and more…

- Dynamic members-only discounts feature that allows you to set discounts to existing members based on their membership level.

- Special actions & filters (for developers)

Add your opinion to the discussion